campervan electrics

rv living

van conversions

We’re Angela & Graham

The heart and soul behind Mowgli Adventures. Since 2013, we’ve been chasing horizons on the road, from Africa’s vastness to the diverse landscapes of South America.

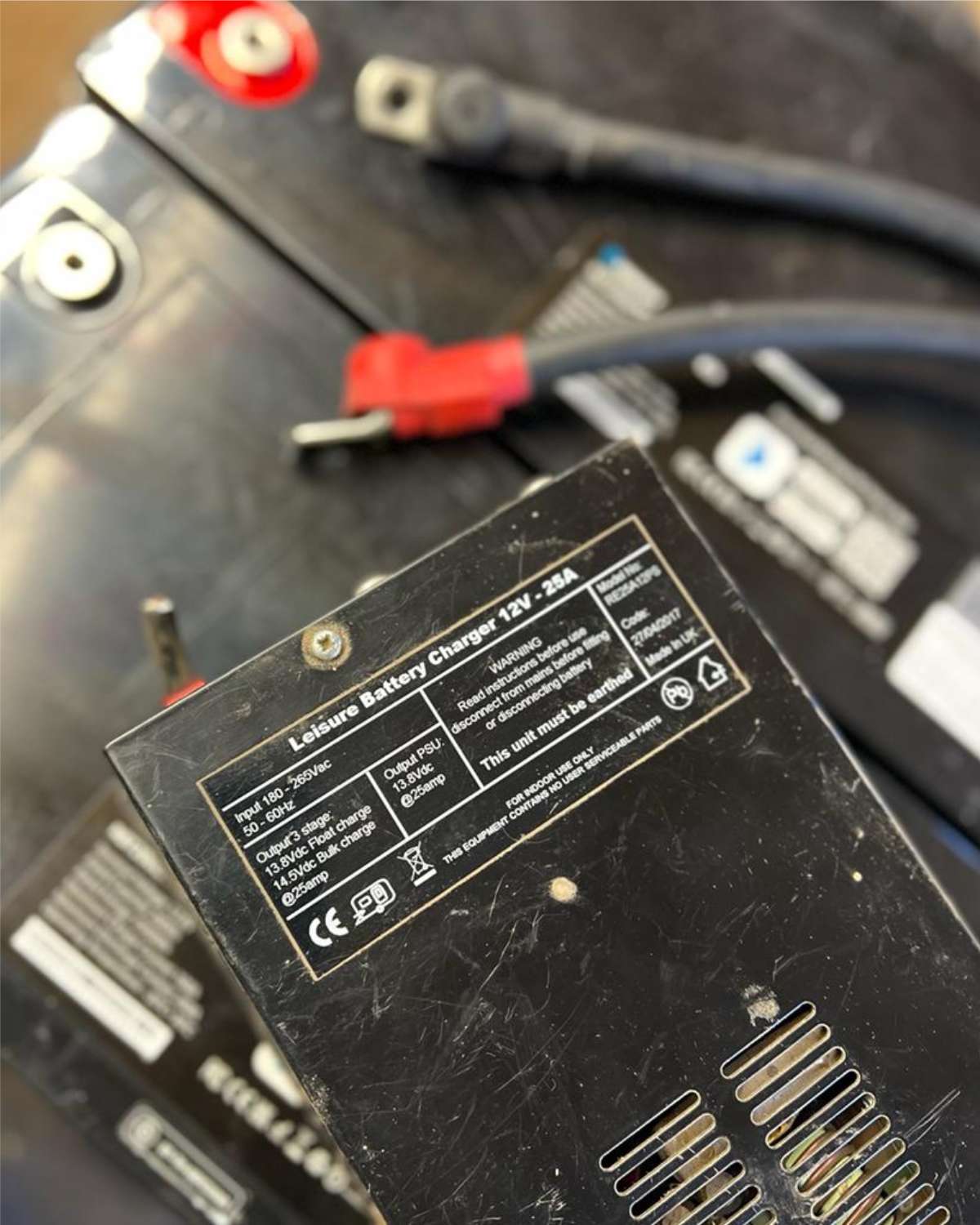

We’ve traveled for over 20 years in DIY converted vans, a Unimog and 4x4s with roof top tents. Electrical demand and systems have evolved and today, we can power induction cookers and residential fridges off-grid if we want to.

Coupled with Graham’s training in marine electrical engineering, our experience means we’re well positioned to provide expert advice to help you design & install a camper van electrical system perfect for your needs.

We’ve walked the walk, put things to the test, and we’re eager to spill all we’ve learned.